A workers' compensation settlement calculator is an online tool that gives you a rough estimate of what your claim might be worth. It's not a guarantee, of course. Think of it as a strategic starting point for both injured workers and their attorneys to get a ballpark figure based on the hard facts of the case.

What Exactly Is a Workers Compensation Settlement Calculator?

Let’s get one thing straight: a settlement calculator isn’t a crystal ball. It’s more like a sophisticated financial modeling tool built specifically for the legal world. It’s an estimation engine, plain and simple. You feed it critical details about the case, and it runs them through a formula to project a potential settlement value.

This is a game-changer for law firms and injured workers because it turns abstract legal details into something tangible: a dollar figure. By plugging in the specifics of an injury and its impact, you get an immediate, data-driven glimpse into what a case could be worth. This is huge for managing expectations right from the start.

A Tool for Strategy and Clarity

For lawyers, this calculator is a cornerstone of the initial case review. It helps answer the client's biggest, most urgent question: "What is my case worth?" It provides a reasonable, evidence-based approximation, which is crucial for building trust and setting a realistic tone for the entire claim process.

It also gives you a much stronger hand to play in negotiations. An attorney who walks in armed with a calculated settlement range can argue far more effectively with insurance adjusters. You're grounding your demands in objective data, not just a gut feeling. The calculator provides a logical framework that justifies the number you’re fighting for.

A settlement calculator shifts the conversation from subjective feelings to objective data. It provides a baseline that anchors negotiations and helps prevent lowball offers from insurance carriers by establishing a clear, calculated starting point.

Core Components of a Settlement Calculation

So, how do these tools actually work? To really get it, you need to look under the hood at the main ingredients. While the exact formulas can vary—especially from state to state—almost every workers compensation settlement calculator is built on a similar set of core inputs.

Understanding these components is the first step to appreciating both the power and the limitations of these estimates. For anyone navigating a particularly complex claim, getting guidance from a specialized law firm is key. You can learn more about finding the right legal professional by exploring how to connect with an employment law attorney near me.

Here’s a quick breakdown of the essential data points that fuel the calculation engine.

Core Components of a Settlement Calculation

This table breaks down the essential data points a workers compensation calculator uses to generate a settlement estimate, providing a quick reference for attorneys.

| Input Variable | What It Represents | Practical Example |

|---|---|---|

| Permanent Disability (PD) Rating | A percentage assigned by a doctor that quantifies the level of permanent impairment from the injury. | A doctor assigns a 15% whole person impairment rating for a chronic back injury. |

| Average Weekly Wage (AWW) | The employee's average earnings per week before the injury occurred. | An employee earned an average of $1,200 per week over the last year. |

| Age and Occupation | Modifiers that adjust the settlement value based on the worker's age and job type at the time of injury. | A 55-year-old construction worker receives a higher modifier than a 25-year-old office worker for the same injury. |

| Future Medical Costs | An estimated amount required to cover all future medical care related to the injury. | A life care planner projects $75,000 for future surgeries, physical therapy, and medication. |

These inputs form the foundation of any credible settlement estimate.

Breaking Down the Core Settlement Formula

At its core, a workers' compensation settlement calculator isn't some black box spitting out random numbers. It's really just a machine built to run a logical formula, much like a recipe. A chef combines specific ingredients in precise amounts to get a perfect dish; a calculator does the same with key legal and financial data to produce a solid settlement estimate.

The fascinating part is that this "recipe" is surprisingly consistent across most states, even if the exact measurements—the local multipliers and rules—can vary wildly. The goal is always the same: translate a real-world injury into a justifiable dollar amount. It all starts by figuring out the long-term impact of that injury on a person's life and their ability to keep earning a living.

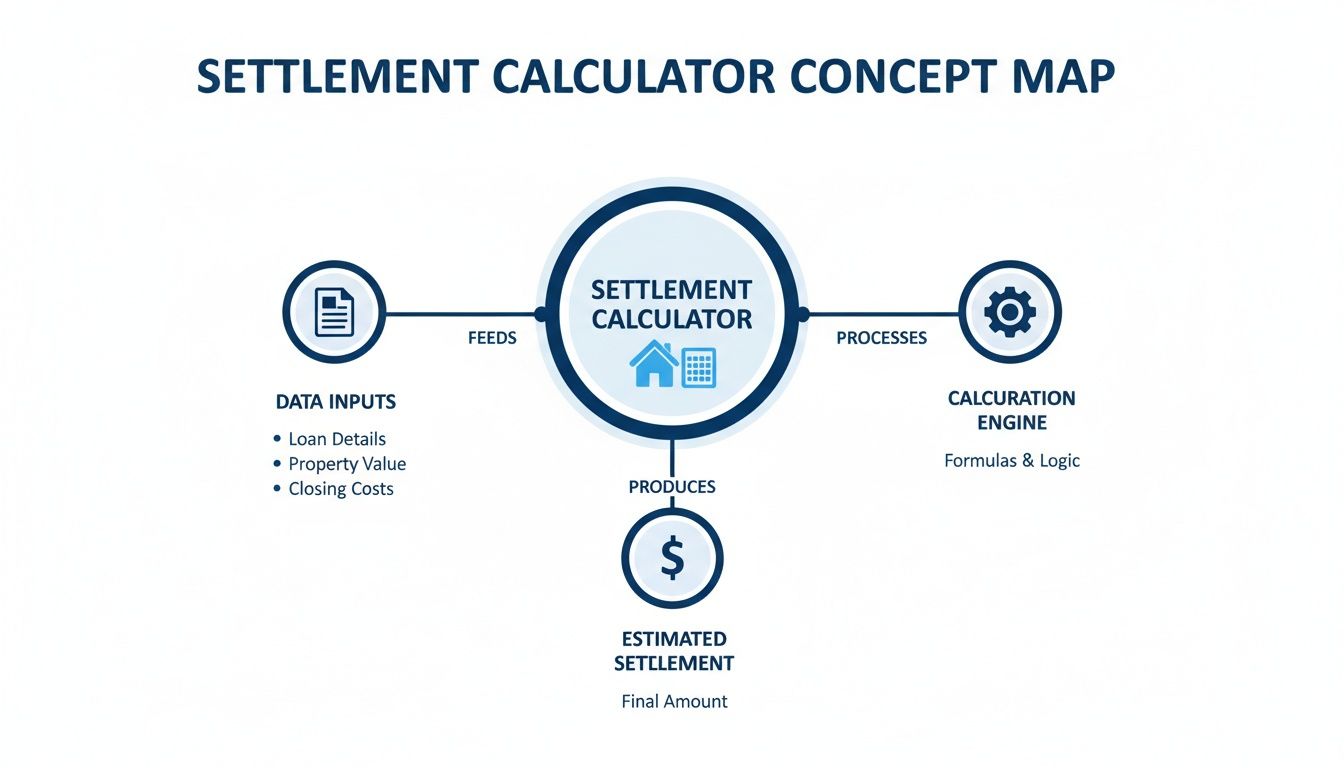

This concept map breaks down the simple yet powerful process. Data goes in, the engine does its work, and a clear estimate comes out.

As you can see, a reliable output is completely dependent on two things: the quality of the input data and the accuracy of the calculation engine. The process isn't a guess; it's a structured way to turn the facts of a case into a financial projection.

The Foundational Variables in Action

Two main variables form the bedrock of almost every calculation: the Permanent Disability (PD) rating and the Average Weekly Wage (AWW).

The PD rating is a percentage a doctor assigns to represent how permanently impaired a worker is. It's the medical system’s formal way of saying, "This is how much this injury will affect you for the rest of your life."

The AWW, on the other hand, sets the financial baseline. It’s a snapshot of what the employee was earning before they got hurt. These two numbers are the primary ingredients every single workers' comp calculator needs to get started. They give you the initial, raw value of the claim before any other factors come into play.

To put it simply, a universal formula might look something like this:

(Permanent Disability Rating %) x (State-Specific Compensation Rate) x (Number of Weeks) = Base Settlement Value

This base value is just the starting point. From here, the calculation gets much more nuanced, layering in adjustments for things like the worker's age, their specific job, and any future medical care they might need.

State Multipliers: The Real Game Changer

While that basic formula provides the framework, the state-specific multipliers are what give the calculation its real-world teeth. Each state has its own schedule that assigns a unique dollar value or number of benefit weeks to different disability ratings and body parts. This is exactly where a generic, one-size-fits-all calculator completely falls apart.

For example:

- A 10% PD rating for a back injury in one state might be worth $15,000.

- That exact same injury and rating in a neighboring state could be worth $25,000, all because of different legislative values.

These multipliers aren't just pulled out of a hat. They’re set by state law and often reflect local economic conditions and political priorities. This is why it is absolutely critical to use a calculator built specifically for the state where the claim is filed. The nuances are everything. For attorneys, mastering these state-specific variables is as crucial as knowing how to craft a compelling story in a legal document. On that note, our guide on creating an effective personal injury demand letter template can help you sharpen that skill.

Navigating California's Complex Workers' Comp System

Let’s be blunt. A generic, one-size-fits-all workers compensation settlement calculator is worse than useless for a California case—it’s actively misleading. The Golden State has a unique and famously intricate system that demands a specialized approach. Just plugging numbers into a standard formula will spit out an estimate that’s completely disconnected from the legal and financial reality of a California claim.

To have any hope of accuracy, a calculator must be built from the ground up to account for the state's specific variables. We're talking about elements that don't even exist in most other states' workers' comp laws. For local law firms, showing you grasp these nuances is what separates the real experts from the rest of the pack.

Understanding the Permanent Disability Rating Schedule (PDRS)

The entire foundation of a California settlement calculation is the Permanent Disability Rating Schedule (PDRS). Don't think of this as a simple list of injuries. It’s more like a complex algorithm in book form. This is the official guide the Division of Workers' Compensation uses to translate a doctor's medical finding into a standardized disability percentage.

The PDRS is incredibly detailed, assigning different values based on a whole range of factors. It goes way beyond just naming the injured body part.

- Injury Specificity: A back injury isn't just a back injury. The PDRS gets granular, distinguishing between different vertebrae, types of motion loss, and levels of chronic pain.

- Occupational Grouping: The schedule is broken down into 49 different occupational groups. A hand injury for a concert pianist (Group 21) is valued much, much higher than the exact same injury for a salesperson (Group 45).

- Age Adjustment: The system also adjusts the rating based on the worker's age when the injury happened, recognizing that an older worker has less time to recover or pivot to a new career.

Any calculator that doesn't reference the right occupational group or apply the correct age modifier from the PDRS is failing at the most fundamental level.

In California, the context of an injury is just as important as the injury itself. The PDRS ensures that a settlement calculation reflects not just the medical impairment, but its real-world impact on a specific person in a specific job.

Apportionment and Its Impact on Value

Another massive factor is apportionment. This is a legal doctrine that forces the doctor to decide what percentage of a worker's permanent disability was directly caused by the work injury versus other things. These "non-industrial" factors could be anything from a pre-existing condition or a prior injury to lifestyle choices.

Here’s how it plays out: a worker is found to have a 20% permanent disability from a knee injury. But the doctor apportions 50% of that disability to pre-existing arthritis. The insurance company is now only on the hook for the 10% caused by the work accident. Just like that, the potential settlement value gets slashed in half. A credible California workers' comp calculator must allow for apportionment inputs to give a realistic estimate.

The DFEC Modifier: A California Original

Maybe the most unique piece of the puzzle is the adjustment for Diminished Future Earning Capacity (DFEC). This is a multiplier applied to the permanent disability rating, and it's designed to account for how an injury will hamstring a worker’s ability to earn money down the road. The multiplier ranges from 1.1 to 1.4, depending on how severe the disability rating is.

This is a critical final step that can't be missed. For example, a base disability payment might be calculated at $50,000. But if the injury is severe enough to get a 1.4 DFEC modifier, that amount gets a 40% boost, bringing the final value to $70,000. Overlooking this state-mandated adjustment leads to a wildly undervalued claim estimate.

These layers of complexity are precisely why a specialized calculator isn't just a nice-to-have—it's an indispensable tool for any California law firm.

Putting the Calculator to Work: A California Case Study

Alright, let's pull all these concepts off the page and see how they work in the real world. Theory is one thing, but watching the numbers come together for an actual case is where it all clicks.

We're going to walk through a hypothetical—but very realistic—California workers' compensation claim to show you exactly how a well-built calculator turns an injury into a solid settlement estimate.

Meet Our Injured Worker: Miguel

Our story starts with Miguel, a 45-year-old construction worker in Los Angeles. He’s a veteran in the trade with over two decades of experience, and before his injury, he was earning an Average Weekly Wage (AWW) of $1,500.

One day on the job, while lifting a heavy beam, he felt a sharp pain in his lower back. It was a severe lumbar spine injury, one that left him with chronic pain and seriously limited mobility.

After months of treatment, his doctor determines he’s reached Maximum Medical Improvement (MMI). A Qualified Medical Evaluator (QME) then steps in, assesses his condition using the AMA Guides, and assigns him a 20% Whole Person Impairment (WPI) rating. This WPI is the medical cornerstone of his claim, but it’s just the first piece of the puzzle.

Step 1: Applying the PDRS Formula

Now, we plug Miguel's details into a California-specific calculator. The first thing it does is run the Permanent Disability Rating Schedule (PDRS) formula to turn that raw 20% WPI into a final Permanent Disability (PD) rating.

- Impairment Number: The calculator identifies the correct code for a lumbar spine injury.

- Occupation Modifier: Construction work is physically brutal (Occupational Group 460). The calculator applies a high modifier—let's call it a "G" variant—which immediately bumps up the value of his impairment.

- Age Adjustment: At 45, Miguel's age adds another small, but important, increase to the rating.

After the PDRS does its work, Miguel's initial 20% WPI is transformed into a Final Permanent Disability (PD) Rating of 32%. This new number isn't just a medical score; it reflects how the injury impacts his life and his ability to work.

This is precisely where a dedicated California calculator earns its keep. It’s not just multiplying numbers. It’s automatically navigating the complex PDRS tables for occupation and age—a critical step that generic, one-size-fits-all tools completely ignore.

Step 2: Calculating the Monetary Value

With the 32% PD rating locked in, the calculator moves on to the money. In California, that percentage translates to a specific number of benefit weeks. For a 32% rating, that's 184 weeks of disability payments.

The weekly payment amount is also dictated by state law. Based on Miguel's $1,500 AWW, his weekly benefit rate is capped at $290.

The initial math is simple: 184 weeks x $290 per week = $53,360.

But hold on, we're not finished. This is California, after all.

Step 3: Applying the DFEC Modifier

Because Miguel’s PD rating is over a certain threshold, a powerful multiplier kicks in: the Diminished Future Earning Capacity (DFEC) adjustment. For his 32% rating, the DFEC multiplier is 1.3. This is a game-changer, designed to compensate him for the fact that his injury will likely reduce his earning potential for the rest of his life.

The final calculation becomes: $53,360 (Base Value) x 1.3 (DFEC Modifier) = $69,368.

This figure gives us a strong estimate for the permanent disability portion of his settlement. A complete valuation would also need to account for any unpaid temporary disability benefits and, crucially, the projected cost of his future medical care.

For law firms trying to stand out, demonstrating this deep, state-specific knowledge is everything. It builds immediate trust and authority. This is a core tenet for attorneys looking to enhance their local marketing in Southern California.

This entire process shows how a proper workers compensation settlement calculator moves past guesswork, offering a structured, data-driven estimate that empowers both attorneys and their clients to make informed decisions.

How Key Factors Impact a Settlement Estimate

To really drive this home, let's see how changing just one variable can dramatically affect the outcome. The table below compares Miguel's case with a few other scenarios.

| Case Scenario | Impairment Rating | Occupation Modifier | Estimated Settlement |

|---|---|---|---|

| Miguel (Our Example) | 20% WPI | High (Construction) | ~$69,368 |

| Office Worker | 20% WPI | Low (Sedentary) | ~$51,000 |

| Construction, Less Severe | 15% WPI | High (Construction) | ~$45,000 |

| Construction, More Severe | 25% WPI | High (Construction) | ~$88,000 |

As you can see, the same medical impairment rating results in a vastly different settlement depending on the injured worker's job. This is why state-specific context isn't just helpful—it's essential for any meaningful calculation.

Why Settlement Calculators Aren't Crystal Balls

A workers' comp settlement calculator is a fantastic tool for getting a ballpark figure for a claim, but it's critical to understand its limits. Think of it like a GPS; it can show you the most direct route, but it can’t predict a sudden traffic jam or a surprise road closure. A calculator crunches the hard numbers of a case with precision, but it has no way of accounting for the unpredictable human factors that so often shape the final outcome.

These tools are built on quantifiable data—things like disability ratings, wages, and age. What they can't measure are the intangibles that can make or break a case during negotiations. A calculator can't tell you how credible a key witness will seem on the stand or gauge the persuasive power of a surgeon's deposition.

The Human Element in Negotiations

The final settlement amount is often molded by factors that live completely outside of a mathematical formula. These variables can swing a claim's value dramatically, which is why human expertise is simply irreplaceable.

A few of these key unquantifiable factors include:

- Strength of Medical Evidence: How solid is the paper trail? Are the doctor's reports clear, detailed, and convincing?

- Witness Credibility: A compelling witness can be a game-changer for your case. A shaky one can sink it.

- The Art of Negotiation: An experienced attorney’s ability to go toe-to-toe with insurance adjusters is a skill that no calculator will ever be able to replicate.

These elements are exactly why a calculator is a starting point for strategy, not the final word. While these tools give you a vital projection, other real-world factors matter just as much. For instance, data shows that injured workers who return with modified duties not only recover 30% faster but also help close claims 20% faster, cutting overall costs by 25%. Understanding these practical dynamics is just as important as the initial calculation. You can find more data-driven insights on key trends reshaping workers' compensation claims on roundtables.us.

A workers' compensation settlement calculator provides the science of a case valuation. An experienced attorney provides the art of securing it. The best outcomes happen when you use both together.

The Importance of Legal Counsel and Disclaimers

Because of these built-in limitations, it’s absolutely critical for law firms to pair any online calculator with a clear, upfront disclaimer. These statements protect your firm and, just as importantly, manage client expectations. They make it plain that the tool provides an educational estimate, not a guaranteed legal outcome. This isn't just good practice; it's a cornerstone of effective and ethical legal marketing, a topic we dive into in our guide on content marketing for law firms.

So, while a calculator offers a useful first look, it's always best to consult with an experienced workers' compensation lawyer. An attorney can analyze the unique nuances of your situation, fight for your best interests, and navigate the complexities that no algorithm can see coming.

Turning Your Calculator Into a Lead Generation Magnet

A well-built workers' comp calculator is so much more than a handy tool for your website. It's one of the most powerful client-attraction assets you can have. Think about it: you’re giving an injured worker immediate, real value by answering their single most urgent question: "What is my case worth?"

This simple act transforms your website from a passive digital brochure into an active engagement hub. Instead of just telling visitors what your firm can do, your calculator shows them. It provides a personalized, data-driven insight that instantly positions you as a helpful authority, long before you ever schedule a consultation. That first impression is everything.

Designing for Conversion

The magic happens when you turn that initial flicker of interest into a real, qualified lead. The key is making the transition from calculation to contact completely seamless. After the calculator delivers its estimated settlement range, it's time for a simple, non-intrusive form to appear.

You're not asking for their life story here. Just the essentials. A proven formula looks like this:

- First Name: So you can personalize your follow-up.

- Email Address: The backbone of your automated communication.

- Phone Number: For direct contact to schedule that crucial first call.

- Brief Case Description (Optional): This is gold. It lets the most motivated prospects give you immediate context.

The goal is to make this exchange feel natural and low-risk, a logical next step for someone who just got a piece of incredibly valuable information.

Promoting Your Lead Magnet

Okay, you've built the perfect tool. Now, you need to get injured workers to actually use it. A multi-channel promotional strategy is non-negotiable. Start by building a dedicated landing page for your calculator, then optimize the heck out of it for search engines. You want to be the top result for phrases like "California workers comp settlement calculator" and "work injury settlement estimate."

Your calculator is the ultimate "top-of-funnel" content. It attracts people at the very beginning of their legal journey, giving you the first and best opportunity to build a relationship and guide them through the overwhelming claims process.

Pair those SEO efforts with highly targeted ad campaigns on platforms like Google Ads. Focusing on long-tail keywords can bring in incredibly qualified traffic, often for a much lower cost per click. For any law firm serious about maximizing its marketing ROI, this is a must. Our guide on lead generation for lawyers is a deep dive into the strategies that work.

Of course, getting the lead is only step one. To truly succeed, you need to master scoring, qualification, and conversion of leads to turn those initial inquiries into signed cases.

The final, critical piece is an automated follow-up system. The moment someone submits their info, they should get an instant confirmation email. From there, a simple sequence of helpful, non-salesy emails—sharing blog posts about the workers' comp process or guides on what to do after an injury—keeps your firm top-of-mind. This nurturing process is how you turn an anonymous website visitor into your next client.

Got Questions About Settlement Calculators? We've Got Answers.

Even after you get the hang of how a workers' compensation settlement calculator works, a few key questions always pop up. Let's clear the air and tackle the most common ones we hear from attorneys just like you.

Just How Accurate Are These Things, Really?

A well-built, state-specific calculator will give you a solid ballpark figure, but its accuracy hinges entirely on the quality of the information you feed it. Think of it less like a crystal ball and more like a high-powered forecasting tool for your negotiation strategy.

The final settlement number is always shaped by things a calculator can't possibly measure—the strength of your negotiation skills, the quality of the medical reports, and heated disputes over future medical care. The calculator gives you a data-driven starting point; you, the attorney, build the winning case from there.

Can Our Firm Just Build Our Own Calculator?

Technically, yes, but it’s a massive undertaking. The formulas have to be perfectly aligned with current state laws—like California’s complex PDRS and DFEC modifiers—which are always being updated. That means constant, painstaking maintenance.

More importantly, it requires serious technical skill to build a tool that’s secure, ADA-compliant, and doesn't frustrate potential clients. For the vast majority of firms, partnering with a legal tech specialist is a much smarter, more efficient way to get a powerful lead-gen tool without the headache and overhead.

The single most important factor in nearly all workers' comp cases is the Permanent Disability (PD) rating. This percentage, determined by a medical evaluator, quantifies the level of lasting impairment and serves as the foundational value for all subsequent adjustments.

Does a Calculator Factor in Future Medical Expenses?

Most professional-grade calculators have a specific field for estimated future medical costs, but that number itself is often one of the biggest points of contention in a case. The calculator simply crunches the number you provide; it can't independently predict what a client will need down the road.

Getting that estimate right is crucial for a fair settlement projection. This is where you might bring in a life care planner to create a detailed, defensible report. That report gives you the number to plug into the calculator and the evidence to back it up during settlement talks. The calculator processes the data, but the attorney has to validate it.

At Case Quota, we specialize in creating high-performance digital marketing strategies that turn your firm's expertise into a powerful client-attraction engine. Discover how our tailored web design and lead generation services can help your law firm grow by visiting us at https://casequota.com.