At the heart of any solid estate plan is a fundamental choice: revocable vs. irrevocable trust. The distinction boils down to a simple trade-off. A revocable trust offers complete flexibility and control over your assets, while an irrevocable trust provides powerful asset protection by making asset transfers permanent. Your decision hinges on a single question: is your primary goal to maintain control, or to shield your assets from future claims and taxes?

Choosing Your Path In Estate Planning

Deciding between a revocable and irrevocable trust is one of the most significant moves you'll make in managing your wealth. Think of a revocable trust as a direct extension of yourself. You can change its terms, swap out beneficiaries, or even dissolve it entirely if your life takes an unexpected turn. This makes it the perfect tool for people whose main goal is avoiding probate—that often painfully slow and public court process for settling an estate.

On the other hand, creating an irrevocable trust is a line you can't uncross. Once you move assets into it, you give up ownership and control for good. While that sounds drastic, it’s precisely that finality that creates a powerful legal shield. Those assets are now generally protected from creditors and lawsuits. More importantly, they're removed from your taxable estate, which can create substantial tax savings for your heirs down the road.

Key Differences at a Glance

To cut through the legalese, it helps to see how these two trusts stack up side-by-side. This quick overview highlights the core trade-offs you’re making with either choice.

Core Differences Between Revocable And Irrevocable Trusts

| Feature | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Flexibility | High – Can be changed or revoked by you at any time. | Low – Permanent and very difficult to modify once created. |

| Asset Protection | None – Assets are still legally considered yours. | High – Protects assets from your creditors and lawsuits. |

| Probate Avoidance | Yes – For assets properly funded into the trust. | Yes – For assets properly funded into the trust. |

| Estate Tax Reduction | No – Assets are included in your taxable estate. | Yes – Assets are removed from your taxable estate. |

| Grantor Control | Full control retained by you, the grantor. | Control is handed over to an independent trustee. |

Seeing it laid out like this makes the strategic differences crystal clear. Each structure serves a very different purpose.

Revocable trusts are the workhorse of modern estate planning for a reason. In fact, over 70% of estate plans involving trusts are revocable. Why? Their unmatched flexibility and ability to keep your financial details out of public probate records are huge draws. This is especially true in states where probate filings can create unwanted exposure for high-net-worth families.

As you start down this road, a comprehensive understanding trusts and estates is non-negotiable. This isn't just about who gets what when you're gone; it’s about your financial security and peace of mind today.

When you get past the textbook definitions, the real differences in the revocable vs. irrevocable trust debate show up in the legal and financial fallout. Your choice has a direct line to how much control you keep, your family’s exposure to creditors, your tax bill, and even whether you can qualify for long-term care benefits. These aren't just abstract legal ideas; they have a very real impact on your wealth and what you leave behind.

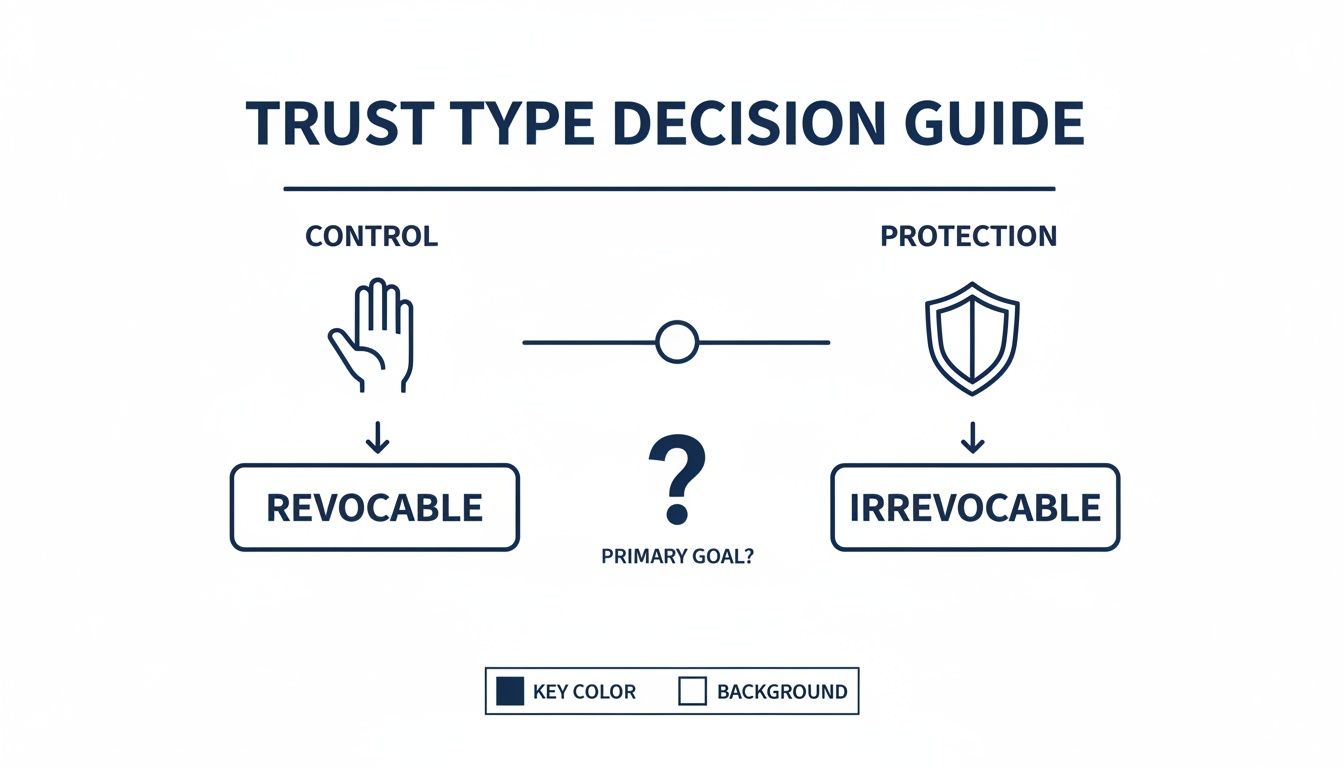

Making sense of these differences is all about matching the right legal tool to your life’s goals. Is keeping total control over your assets the top priority, or is it more important to build a fortress around them? Your answer will shape your entire strategy.

This decision tree gives you a visual on that fundamental choice: if control is king, you're looking at a revocable trust. If protection is the name of the game, an irrevocable trust is the answer.

The image boils it down to the core trade-off. The road to a revocable trust is paved with flexibility, while the road to an irrevocable trust is built on a foundation of solid security.

Flexibility And The Right To Amend

The biggest selling point of a revocable living trust is its adaptability. As the grantor, you hold all the cards and can change or even completely tear up the trust whenever you want during your lifetime. That means you can add or drop beneficiaries, swap out trustees, or just pull assets back into your own name without asking for anyone's permission.

This kind of control makes it the perfect tool for people whose financial lives or family dynamics might shift over time. If a relationship with a beneficiary goes south or you decide to sell a house held by the trust, you can amend the document without a major legal headache.

An irrevocable trust, on the other hand, is built to be permanent. Once you sign on the dotted line and transfer assets in, you’ve given up your right to make changes. Trying to modify an irrevocable trust is a serious legal undertaking, often requiring every single beneficiary to agree—and sometimes even a judge to sign off on it. That rigidity is the cost of admission for its protective perks.

Asset Protection From Creditors And Lawsuits

Here’s where the roles completely flip. A revocable trust offers precisely zero asset protection from your personal creditors. Because you still have full control and can dissolve the trust at will, the law sees those assets as yours. If you get sued or have a judgment against you, creditors can almost always get to the assets inside your revocable trust.

This is where an irrevocable trust really flexes its muscles. When you move assets into an irrevocable trust, you legally hand over ownership. The result? Those assets are now generally off-limits to your future creditors, lawsuits, and even claims in a divorce.

Key Insight: Giving up control is what puts up the protective wall. For doctors, contractors, and other professionals in high-risk fields, this protection is often the single most powerful reason to opt for an irrevocable trust.

Impact On Estate And Income Taxes

The tax treatment for each trust is night and day. With a revocable trust, any income the trust’s assets generate flows right onto your personal tax return, reported using your Social Security number. And when it comes to estate taxes, those assets are still counted as part of your gross estate because, legally, you never really let them go.

An irrevocable trust is a whole different animal. It’s treated as a separate legal entity with its own tax ID number (EIN), and it has to file its own tax returns. More importantly, it can unlock some serious estate tax savings.

For clients with significant wealth, irrevocable trusts are a go-to strategy for minimizing estate taxes. By moving assets into the trust, you remove them—and all their future growth—from your taxable estate. This can shield a fortune from the 40% federal estate tax that kicks in above the exemption amount.

Medicaid And Long-Term Care Planning

The staggering cost of long-term care can wipe out a lifetime of savings in a hurry. While an irrevocable trust can be a game-changer for Medicaid planning, a revocable trust does absolutely nothing to help. Any asset in your revocable trust is considered fully countable when Medicaid determines your eligibility.

By moving assets into a carefully drafted irrevocable trust, you start a critical clock. Medicaid has a "look-back" period—usually five years—where it scrutinizes any asset transfers you've made. If you transfer assets into an irrevocable trust and remain healthy for that five-year window, those assets are generally no longer on Medicaid's radar, preserving them for your heirs. Navigating these rules gets complicated fast, as seen in regulations like Indiana's Medicaid Look-Back Rules.

Avoiding The Probate Process

One huge advantage both trusts share is their ability to sidestep probate. Probate is the court-managed process of settling an estate, and it’s notoriously slow, expensive, and public.

Any asset that is properly titled in the name of either a revocable or an irrevocable trust passes directly to your chosen beneficiaries based on the instructions in the trust document. This completely bypasses the probate court, ensuring a quicker, more private, and far less costly transfer of your legacy to your loved ones. This feature is a cornerstone of modern estate planning, no matter which path you choose.

Real-World Scenarios for Choosing Your Trust

Legal theory and definitions are one thing, but the real test in the revocable trust vs. irrevocable trust debate is how they perform in the real world. To make this tangible, let's walk through three common situations to see why one trust is the clear winner for each.

These stories will probably feel familiar. The goal is to help you see your own circumstances reflected in them, clarifying which path might be the right fit for your family and financial goals.

The Young Family Building a Foundation

Meet Alex and Sarah. They're in their late 30s with two young kids and a new mortgage. Their goals are straightforward but absolutely critical: name a guardian and make sure their assets pass to their children without getting stuck in court if the unthinkable happens. They're still building wealth, so they know their financial picture will look very different in ten years.

For them, flexibility is everything. Their must-haves are:

- Avoiding Probate: They need their home and savings to be immediately available to a guardian to care for the kids, not tied up in a public, lengthy court process.

- Appointing Guardians: Naming the right person to raise their children is their absolute top priority.

- Maintaining Control: As their careers grow, they need to easily add new assets and adjust their plan.

The revocable living trust is the ideal choice here. It allows them to title their house and other major assets in the trust's name, which is the key to bypassing probate. Inside that document, they can name their guardian and leave detailed instructions on how the money should be used for their kids' education, health, and upbringing.

Most importantly, if they have another child, buy a vacation property, or change their mind about an heir, they can amend the trust with minimal fuss. An irrevocable trust would be far too rigid for this stage of life. It would lock away assets they might need and prevent the very adjustments a growing family requires.

The Business Owner Protecting a Legacy

Now, let's look at David, a 62-year-old business owner with a commercial real estate portfolio worth $15 million. His net worth is well over the federal estate tax exemption, and his main worries are protecting his wealth from business lawsuits and shielding his kids from a massive estate tax bill.

David's priorities are a world away from Alex and Sarah's. He's focused on:

- Asset Protection: His industry is litigious. He wants a firewall between a business lawsuit and the personal wealth he plans to leave his family.

- Estate Tax Minimization: He's worked too hard to see a huge chunk of his legacy go to the IRS.

- Legacy Preservation: He has a specific vision for how his wealth should be managed for generations to come.

Strategic Choice: For David, the permanence of an irrevocable trust isn't a drawback; it's the entire point. It creates the legal separation needed for powerful protection and tax reduction.

For David, an irrevocable trust is the superior strategic tool. By moving a portion of his real estate and investments into a properly designed irrevocable trust, he legally severs his ownership. This single action solves two huge problems at once. First, those assets are now protected from future creditors and legal judgments. Second, their value—and all future growth—is removed from his taxable estate, a move that could save his heirs millions in taxes.

Yes, he gives up control, but at his age and with his level of wealth, it’s a smart trade-off. This decision directly addresses his biggest concerns in a way a revocable trust simply cannot.

The Pre-Retiree Planning for Long-Term Care

Finally, there’s Susan, a 68-year-old widow with a modest home and about $400,000 in retirement savings. She’s healthy now, but she knows that the crushing cost of nursing home care could wipe out everything she's saved, leaving nothing for her kids. Her goal is to protect her assets while planning for potential Medicaid eligibility down the road.

Susan’s objective is laser-focused: Medicaid asset protection. She needs a way to legally distance herself from her assets so she can qualify for assistance without being forced to spend every last dollar first.

In this case, a special type of irrevocable trust—often called a Medicaid Asset Protection Trust (MAPT)— is the only real solution. By transferring her home and savings into this trust, Susan starts the clock on Medicaid’s five-year "look-back" period. After five years have passed since the assets were moved, they generally won't be counted against her when determining her eligibility for benefits.

A revocable trust would be useless here. Medicaid sees any asset in a revocable trust as fully yours and completely countable. For Susan, giving up control over the trust principal is the necessary step to preserve it for her children. When long-term care costs are the primary threat, the choice between a revocable vs. irrevocable trust becomes crystal clear.

Understanding Trust Funding And Administration

Signing the trust document is a huge milestone, but it's only the beginning. Think of a trust as a vessel; it’s legally empty and can’t do its job until you actually transfer your assets into it. This critical step is called funding the trust.

If you skip this part, your trust controls nothing. Your assets will almost certainly get dragged into probate court, which defeats one of the most powerful reasons for creating a trust in the first place. The funding process involves legally retitling your assets—your home, bank accounts, investments—from your individual name into the name of the trust. This isn't a passive exercise; it requires focused, deliberate action for every single asset.

It’s this official change in ownership that unlocks all the benefits of a trust, whether it's revocable or irrevocable. But once funded, the day-to-day management and administrative burdens for each trust type couldn't be more different.

The Funding Process In Practice

Whether you've opted for a revocable or irrevocable trust, the initial funding mechanics are pretty much the same. You have to formally change the legal title of your assets, a meticulous process where the details really matter.

Here’s what that typically looks like:

- Real Estate: You'll sign a new deed to transfer your property from your name to the trust's name. That new deed then gets filed and recorded with the county.

- Bank Accounts: Your bank will need you to either retitle your existing accounts or open new ones in the name of the trust. This usually means filling out new signature cards and providing a copy of your trust agreement.

- Investment Accounts: Just like with bank accounts, you’ll work with your brokerage firm to move your non-retirement investment accounts under the trust's ownership.

- Business Interests: For an LLC or partnership, this means amending the operating agreement or other corporate documents to show the trust is now the owner.

This can be a complex and tedious process. A single misstep could leave a valuable asset outside the trust, completely exposed to probate.

Administration Of A Revocable Trust

One of the biggest draws of a revocable trust is how simple it is to manage during your lifetime. Since you, as the grantor, are almost always the trustee, you handle the trust assets just like you always have.

You can buy and sell property, direct your investments, and write checks without asking anyone for permission. From a tax perspective, it’s invisible. The IRS considers it a "grantor trust," so all income is reported on your personal tax return using your Social Security number. There’s no need for a separate tax ID number and no annual trust tax filings. That simplicity is a huge plus.

Administration Of An Irrevocable Trust

The administrative reality of an irrevocable trust is a different world entirely. Once you fund it, the trust becomes its own separate legal and tax-paying entity, which brings a whole new set of non-negotiable responsibilities.

Key Takeaway: An irrevocable trust functions like its own small business. It needs its own bank account, must file its own tax returns, and requires a trustee who has a strict, legally-binding duty to the beneficiaries.

This structure demands a much higher level of formality and careful management. Here are the core administrative duties:

- Appointing an Independent Trustee: To get the asset protection and tax benefits you’re after, you can't be your own trustee. You have to name an independent third party—a trusted family member, a professional, a bank, or a trust company—to manage everything.

- Obtaining a Tax ID Number (EIN): The trustee is responsible for applying to the IRS for an Employer Identification Number (EIN). This is the trust's unique tax ID, much like your Social Security number.

- Filing Annual Tax Returns: The trust must file its own income tax return, a Form 1041, every year to report any income it earns. This is completely separate from your personal tax filings.

- Maintaining Detailed Records: The trustee has a fiduciary duty to keep meticulous records of every transaction, every distribution to a beneficiary, and all administrative costs.

This ongoing administrative workload is a massive factor in the revocable trust vs irrevocable trust decision. It represents a significant commitment of time and money for the long haul.

When you're weighing a revocable trust against an irrevocable one, it's not really about which is "better." It's about deciding which strategic trade-offs you're willing to make to get to your ultimate goal.

This isn’t about running through a simple pro/con list. It's a calculated choice between keeping total, absolute control over your assets and locking in powerful, long-term protection for your legacy.

Framed that way, the decision becomes much clearer. Are you willing to give up asset protection so you can change your mind tomorrow? Or is the peace of mind that comes from shielding your life’s work worth giving up control today?

The Revocable Trust Trade-Off: Control For Exposure

The big draw of a revocable living trust is the unparalleled control it gives you. You're the master of your domain. You can amend beneficiaries, sell off assets, or even tear up the whole trust on a whim.

Functionally, it mirrors your current ownership, which makes managing everything during your lifetime incredibly seamless. There are no extra tax IDs to get or separate tax returns to file. It's simple.

But that total control comes at a steep price: zero asset protection. Since the law sees the trust's assets as your personal property, they are completely exposed to creditors, lawsuits, and legal judgments. On top of that, these assets are still considered part of your taxable estate, so a revocable trust offers no advantage for reducing estate taxes. The strategic choice here is to prioritize flexibility, but you have to accept the trade-off of total vulnerability to financial threats.

The key question to ask yourself: Is my main goal just to avoid probate and keep maximum control, even if it means my assets are left unprotected and part of my taxable estate?

The Irrevocable Trust Trade-Off: Permanence For Protection

On the other side of the coin, the irrevocable trust demands a major sacrifice—you permanently give up control. Once you move assets into an irrevocable trust, they aren't legally yours anymore. This is a final, serious commitment.

This move requires you to appoint an independent trustee and follow strict rules, which includes filing separate tax returns for the trust. It’s a whole different ballgame.

But the reward for making that sacrifice is elite-level protection. Assets held inside a properly structured irrevocable trust are shielded from your future creditors and lawsuits. It creates a legal fortress around your wealth. For high-net-worth individuals or professionals in high-risk fields, this is the core of the revocable trust vs irrevocable trust debate. What's more, by getting those assets out of your name, you can create substantial estate tax savings for your heirs. The trade-off is crystal clear: you swap control and simplicity for powerful, lasting security.

Strategic Trade-Offs In Trust Selection

This table really boils down the strategic give-and-take between the two. It's designed to help you see which path aligns with what you value most—flexibility or protection.

| Strategic Consideration | Revocable Trust | Irrevocable Trust |

|---|---|---|

| Primary Advantage | Absolute flexibility and grantor control. | Superior asset protection and tax reduction. |

| Core Sacrifice | No protection from creditors or estate taxes. | Permanent loss of direct control and access. |

| Administrative Burden | Low; managed as personal assets. | High; requires a separate trustee and tax filings. |

| Ideal User Profile | Individuals prioritizing probate avoidance and adaptability. | Individuals focused on wealth preservation and tax efficiency. |

Ultimately, this all comes down to identifying your non-negotiable priority.

If you think your circumstances might change or you know you'll need easy access to your assets, the revocable trust's flexibility is indispensable. But if your number one goal is to build a firewall that protects what you've built for future generations, then the irrevocable trust's permanence is its greatest strength.

Making Your Decision With A Professional

You now have the foundational knowledge to understand the critical differences between a revocable and irrevocable trust. Armed with this information, you can walk into an attorney's office ready for a far more productive and focused conversation. The goal isn't to know everything, but to know what matters most to you.

Before you book that meeting, take a moment to think about your primary objective. Is your top priority maintaining total control and flexibility over your assets for the rest of your life? Or are you more concerned with building a fortress around your wealth to protect it from future lawsuits, creditors, or a hefty estate tax bill? Your answer is the starting point for any meaningful plan.

Preparing for Your Attorney Consultation

To get the most out of your time with an attorney, a little prep work goes a long way. Having answers to these questions will help your lawyer give you precise, actionable advice.

- What's Your "Why"? What is the single most important outcome you need your trust to achieve? Is it avoiding probate at all costs? Protecting assets? Reducing taxes? Planning for Medicaid eligibility down the road?

- What Do You Own? Put together a general list of your major assets—real estate, investment accounts, business interests, and so on.

- Who Is It For? Think about your beneficiaries and any unique family dynamics that might influence your decisions.

This guide is designed to get you up to speed on the concepts, but it's no substitute for personalized legal advice. Trust laws vary dramatically from one state to the next, and a strategy that’s rock-solid in one jurisdiction could be completely ineffective in another. For legal professionals trying to reach clients weighing these options, grasping local-level marketing is key, a topic covered in discussions on effective estate planning attorney marketing.

Final Takeaway: A trust's ultimate purpose is to make sure your specific wishes are carried out. A generic, one-size-fits-all approach is a recipe for disaster in estate planning.

The final, most critical step is to sit down with a qualified estate planning attorney. They are the only ones who can analyze your complete financial picture, listen to your family's needs, and architect a trust that truly aligns with your long-term goals. Taking this step ensures your estate plan isn't just a stack of documents, but a powerful and effective tool for securing your legacy.

Answering Your Clients' Toughest Trust Questions

When you're guiding clients through the revocable vs. irrevocable trust decision, a few key questions almost always come up. Having clear, confident answers is essential to helping them choose the right path for their family and their assets.

Let's break down some of the most common sticking points.

Can an Irrevocable Trust Really Never Be Changed?

This is a big one. While "irrevocable" sounds utterly permanent, it's not quite set in stone. The reality is that modifications are possible, but they're a world away from the simple amendment process of a revocable trust. It’s a complex legal undertaking.

There are a few avenues we can pursue to make changes:

- Decanting: Think of it as "pouring" the assets from an old, outdated trust into a new one with better, more modern terms. This has become a powerful tool in many jurisdictions.

- Beneficiary Agreement: In some states, if you can get a unanimous agreement from every single beneficiary, the court may allow for modifications. Getting everyone on the same page is often the biggest hurdle.

- Court Order: We can petition a judge to approve changes if a major life event or a shift in circumstances fundamentally undermines the trust's original purpose.

These options are never guaranteed and often come with significant legal costs. The key takeaway for clients is that flexibility is limited and comes at a price.

Do I Lose All Access to Assets in an Irrevocable Trust?

Not necessarily, but this is where the drafting gets incredibly nuanced. While your client gives up direct control—that’s the whole point—some advanced strategies can provide indirect benefits. For example, a Spousal Lifetime Access Trust (SLAT) allows the trustee to make distributions to your client's spouse, which can indirectly benefit the household.

In most standard irrevocable trusts, however, the grantor permanently cuts off their own direct access to the assets. It’s the fundamental trade-off they make to gain powerful asset protection and estate tax advantages.

Crucial Point: Any provision that allows for potential access for the grantor has to be drafted with surgical precision. One wrong move and you could unintentionally invalidate the very protections the trust was designed to create.

If I Have a Revocable Trust, Do I Still Need a Will?

Yes. 100% yes. This is a non-negotiable part of a comprehensive plan. A trust can only control the assets that have been legally titled in its name. It's incredibly common for a new bank account to be opened or a piece of property to be acquired just before death that never makes it into the trust.

A pour-over will is the critical safety net here. This special type of will acts as a backstop, directing that any assets owned at death that weren't properly funded into the trust should be "poured over" into it. It’s the final step that ensures everything is managed under one cohesive plan, protecting your client's ultimate wishes.

At Case Quota, we understand the nuances that attorneys must communicate to their clients. We help estate planning law firms connect with individuals seeking this vital guidance through targeted digital marketing. Learn how we can help your practice grow at https://casequota.com.