As the year winds down, many law firms are looking for ways to optimize their finances. While year-end often brings thoughts of holiday cheer, it’s also a critical time to consider strategic marketing investments that can lead to significant tax advantages. Smart allocation of marketing dollars before December 31st isn’t just about growing your firm – it’s about maximizing your tax incentives.

The Power of Deductions: Why End-of-Year Marketing Matters

Many marketing expenses are fully deductible business expenses. This means that every dollar you spend on eligible marketing activities can reduce your firm’s taxable income. For law firms, this can translate into substantial savings, especially when looking at the potential impact on your overall tax liability.

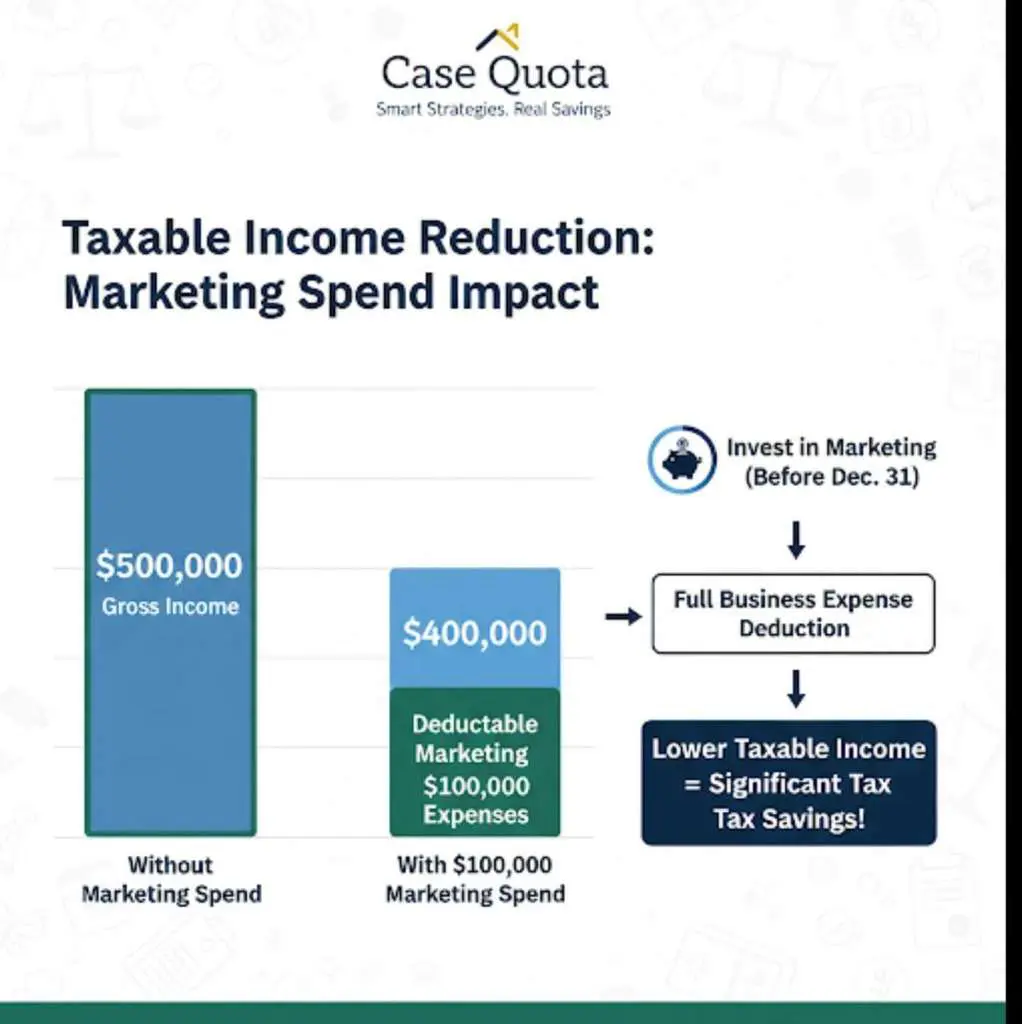

Consider this simplified illustration of how deductions can impact your taxable income:

Investing in marketing isn’t just about getting new clients; it’s about strategically managing your firm’s finances.

Common Deductible Marketing Expenses for Law Firms:

- Advertising Costs: Online ads (Google, social media), print ads, radio, TV.

- Website Development & Maintenance: SEO services, hosting, content creation.

- Professional Services: Marketing consultants, graphic designers, videographers.

- Promotional Materials: Brochures, business cards, branded merchandise.

- Networking & Sponsorships: Event sponsorships, professional memberships.

- Client Entertainment (Limited): While more restricted, certain client entertainment expenses can still be deductible.

How Savvy Firms Leverage This Strategy

Many well-managed law firms don’t wait until January to plan their marketing budget. Instead, they look at their profitability projections towards the end of the year and identify opportunities to strategically invest in marketing. If a firm is anticipating a higher-than-usual profit, deploying those funds into deductible marketing expenses can:

- Reduce their current year’s tax burden: By lowering their net income, they reduce the amount of tax owed.

- Generate future business: The marketing efforts themselves lay the groundwork for new cases and growth in the upcoming year.

- Enhance brand visibility: Increased spending can boost their firm’s profile and reputation.

It’s a win-win scenario: greater market presence combined with tax efficiency.

Looking Ahead: How Case Quota Can Help in 2025 and Beyond

While maximizing tax incentives with end-of-year spending is a smart move, the benefits of strategic marketing extend far beyond a single tax season. At Case Quota, we understand the unique challenges and opportunities law firms face.

For 2025, consider how a consistent and well-planned marketing strategy can significantly alleviate your firm’s taxes come tax season. By partnering with Case Quota, you can:

- Develop a comprehensive marketing plan: We help you identify the most impactful channels and strategies for your specific practice areas.

- Track and optimize your spend: Ensure every marketing dollar is working efficiently, providing tangible ROI and clear deductible expenses.

- Leverage year-round deductions: Don’t just think about year-end; build a marketing budget that continuously optimizes your tax position.

- Quantify your marketing ROI: Understand how your marketing investments are directly contributing to case acquisition and firm growth.

Imagine going into tax season confident that your marketing investments throughout the year have not only driven client growth but also intelligently reduced your firm’s taxable income. That’s the power of strategic marketing with Case Quota.

Don’t let valuable tax incentives slip away. Let Case Quota help your firm make smart, tax-efficient marketing decisions that fuel your growth for years to come.